UI/UX Design

TDECU DIGITAL BANKING

PROBLEM

TDECU, a rapidly growing credit union based in Lake Jackson, Texas, needed to launch its first mobile banking app to give members secure and convenient access to their accounts. With no existing app in place, the challenge was to deliver a seamless, branded, and fully functional mobile experience that could support everyday banking while reinforcing member trust. As one of Kony’s new flagship clients, this project also served as a proving ground for the scalability and adaptability of the Kony Banking App template.

goal

The objective was to design and deliver TDECU’s first mobile banking application by customizing the Kony Banking App template to fit the credit union’s specific needs. The app had to feel intuitive, accessible, and secure while reflecting TDECU’s brand identity and ensuring long-term scalability for future enhancements.

role

As UI/UX Designer, I partnered closely with the TDECU team and Kony developers over the course of a year to shape both the experience and the interface. I refined user flows, optimized screen layouts for clarity and usability, and built a consistent visual language aligned with TDECU’s brand. My role was to ensure that the app not only met functional requirements but also delivered a cohesive, user-friendly digital banking experience from day one.

KEY RESPONSIBILITIES

I was responsible for customizing and optimizing both the mobile and web banking experiences for TDECU. Using Kony’s pre-built UX components as a foundation, I adapted them into fully branded solutions that aligned with TDECU’s identity and operational processes. Since TDECU was working with two different brands, I ensured that each platform reflected its respective branding while maintaining usability and consistency. I acted as the bridge between the client and the development team, gathering feedback through onsite sessions and facilitating clear communication throughout the project lifecycle. My role involved refining user flows, applying brand standards, and designing interfaces that were intuitive, secure, and cohesive. The result was a seamless digital experience where members could confidently manage their accounts across both mobile and web platforms.

design system components

To ensure consistency and efficiency across both mobile and web platforms, I established a set of reusable components including buttons, input fields, and icons. These elements were tailored to align with TDECU’s brand standards while maintaining flexibility for future iterations. By defining a clear system of components, the design process became more agile and scalable, allowing for quicker updates, streamlined collaboration with developers, and a cohesive experience for end users across different contexts.

Sample Feature Showcase: MObile BIll payments

TDECU’s mobile and web app included more than thirteen key features designed to simplify members’ banking experiences. To demonstrate the depth of my work, this section highlights the Bill Payments feature and the design decisions that shaped it. Every feature was created from start to finish with careful consideration of all possible user outcomes, ensuring that no interaction was left unresolved. The process applied here reflects the broader approach I used across the app, delivering consistency, usability, and seamless interaction across both mobile and web platforms.

User Flow

A key step in designing the Bill Payments feature was compiling all of TDECU’s requirements to ensure every payment scenario could be completed smoothly. The resulting flow maps out the exact information members need to provide, from selecting payees to confirming details, creating a clear and reliable path for transactions. By aligning business requirements with user needs, this flow served as the foundation for intuitive design decisions across both mobile and web.

1. First-Time Interaction

The bill payment feature was designed to guide members through a seamless and intuitive experience from start to finish. First-time users are introduced to the setup process with clear guidance, accommodating scenarios with or without a default account. Key actions are highlighted at every step, ensuring users can complete their initial setup efficiently and confidently.

2. Managing Payees

Once the account is set up, managing payees becomes straightforward. Users can add new payees, update existing ones, or remove outdated entries with immediate visual feedback confirming success or highlighting errors. Steps are structured to reduce confusion and make each task efficient, allowing users to focus on critical actions without distraction.

3. Payment Types

Payment options provide members full control over their transactions. Choices such as transfer now, one-time, date range, and recurring payments are clearly presented, with confirmations for successful or failed actions. These flows simplify decision-making and reduce errors, supporting both new and experienced users in completing their payments confidently.

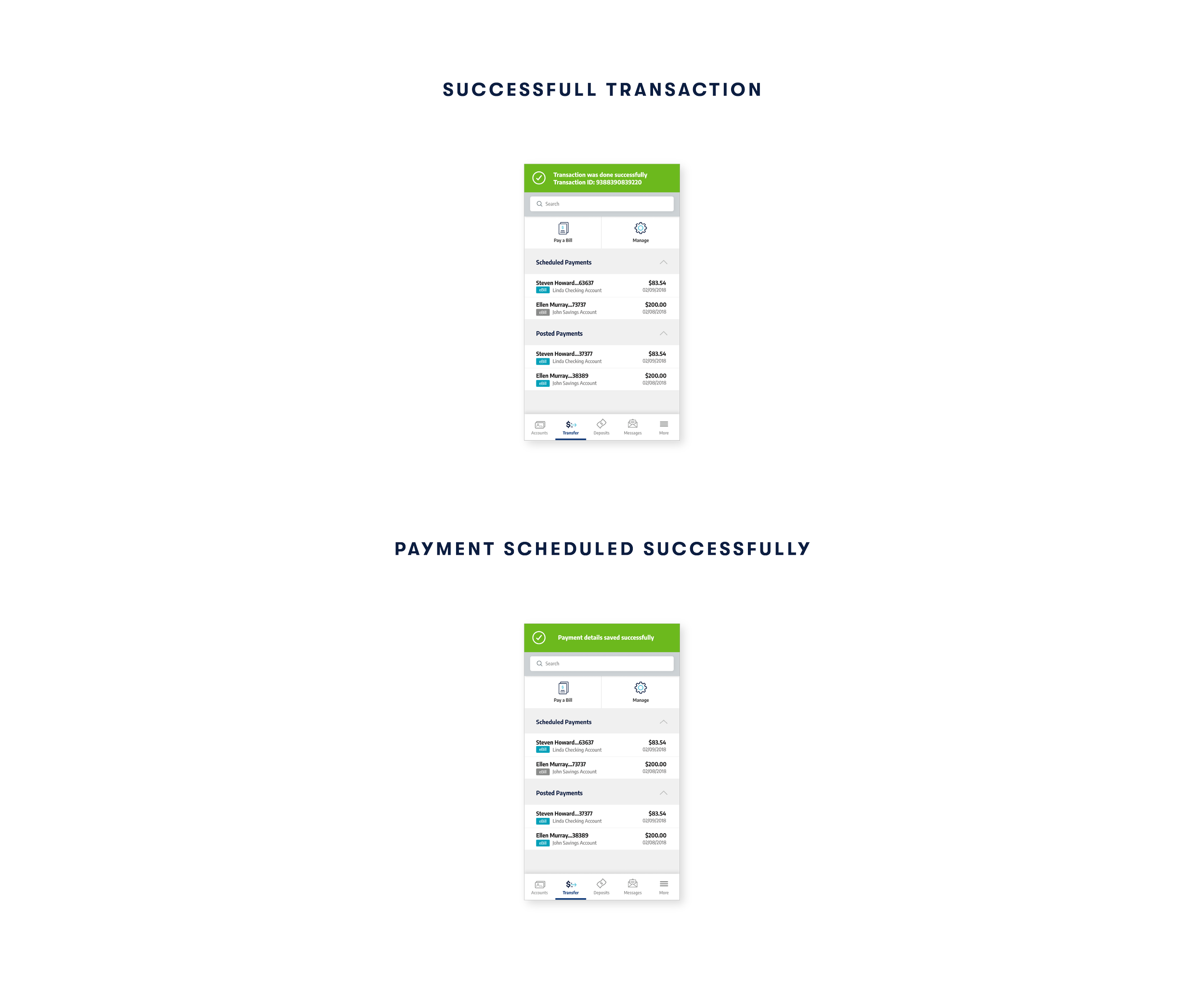

4. Confirmation

The process concludes with a clear confirmation step, reinforcing transaction outcomes and providing immediate reassurance. By combining structured guidance, visual feedback, and intuitive interactions, the bill payment feature delivers a reliable, consistent, and user-centered experience across both mobile and web platforms.

Sample Feature Showcase: web BIll payments

The web interface mirrors the mobile experience, maintaining consistency in interactions, and key workflows. Rather than repeating each step, this section focuses on how the design adapts for larger screens, including layout optimizations, additional contextual information, and enhanced navigation patterns. These adjustments leverage the desktop environment to provide a richer, more detailed view while preserving the intuitive and user-centered principles established on mobile.

Key Differences

Layouts take advantage of wider screens, presenting information in multi-column formats where appropriate

Expanded tables or grids provide a clearer overview of payees and scheduled payments

Navigation adapts to desktop patterns, offering persistent menus without sacrificing clarity

By emphasizing platform-specific enhancements and thoughtful adaptations, the web flow complements the mobile experience while ensuring users encounter a seamless and consistent interaction across devices.

Core Banking Features

TDECU’s mobile and web platforms provide a comprehensive set of features designed to give members full control over their finances while maintaining security, clarity, and convenience. Each feature was designed to support intuitive interactions, streamline workflows, and ensure consistency across devices.

ENROLLMENT

Guides users through the onboarding process, including setting up passwords, security questions, and verifying identity for secure access to online banking.

PAY BILLS

Enables members to enroll in bill payment services, set up default accounts, add payees, and schedule recurring payments for a convenient experience.

ADDING ACCOUNTS

Enables members to enroll in bill payment services, set up default accounts, add payees, and schedule recurring payments for a convenient experience.

LOAN REMITTANCE

Supports loan payment management, allowing members to schedule and track payments efficiently.

AUTHENTICATION

Provides multiple login options including Face ID, Touch ID, and PIN, while allowing username updates for secure and flexible access.

tRANSFERS

Streamlines the transfer process for moving funds between internal accounts or sending money to external accounts.

MANAGE PAYEES

Enables members to add, edit, and remove payees, keeping recipient management simple and organized.

ACCOUNT MANAGEMENT

Allows users to check balances, review transaction history, and update account details with ease.

ACH TRANSFERS

Supports personal and business ACH transfers, enabling secure sending and receiving of payments.

WIRE TRANSFERS

Facilitates domestic and international wire transfers, providing a secure and efficient way to move money across regions.

OUTcome

The TDECU mobile and web banking platforms provided members with a seamless, secure, and fully branded digital experience. Users can confidently perform essential banking tasks, from managing accounts and transferring funds to paying bills and tracking loans. By creating clear workflows, consistent UI components, and platform-specific enhancements, the app reduced friction, minimized errors, and improved overall efficiency. The project strengthened member trust in TDECU’s digital services, supported wider adoption of online and mobile banking, and established a scalable foundation for future features and enhancements.